Part III continues with Edmond’s first three examples:

- New Zealand throughout the 1980s

- France in the early 1980s

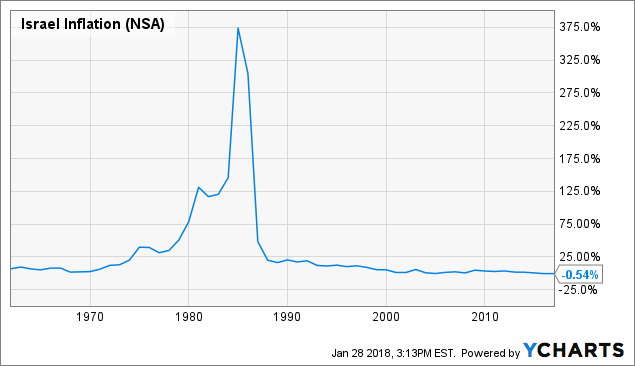

- Israel mid 1980s hyperinflation

France

For starters, as in the cases in Part II, we see the twin oil supply inflationary events of the 70s/early 80s. In France, there is a steady and sharp decline in inflation from 1980 to 1986. Taking a snapshot of any one year from the “early 80s” and attributing it to government spending does not make sense – inflation was steadily declining. In other words, the Mitterrand government may have been spending more ( 110 Propositions for France), yet inflation was decreasing rapidly.

An aside – Like Spain, the steep 1950s inflation was in the context of a net good due to unprecedented growth and real living standard improvements in the country. To the extent that the period even has a name, Les Trente Glorieuses. Trente Glorieuses.

ISRAEL

Note- to some degree I would not consider 1980’s Israel a fully (geo)politically-stable peacetime country.

Also, if you don’t see this (already trending on the Iranian Revolution, wage indexation etc):

….as a direct result of this….

Then I don’t know what to tell you. Wars cause inflation. Losing them causes currency collapse (Aka “hyperinflation”) and Israel was not truly a “winner” in the conflict above.

And these expenses continued throughout the mid-80s, from a country with a population of around 4.2 million people in 1985 .

But even if we do count this as peacetime spending, the causes and cure to the Israeli high inflation period are extremely complex, and in no way obviously connected to “government spending.” It is true part of the complex (much studied because of its success) response involved a reduction in spending. But there were other large economic policy changes made at the same time. I wouldn’t “deny” Edmond this example but it is certainly not clear cut by any means (wage indexation, unions, etc).

This article summarizes the issues: Reuveny, Rafael. 1997. “Democracy, Credibility, and Sound Economics: The Israeli Hyperinflation” Policy Sciences. Vol. 30, No. 2 (1997), pp. 91-111 https://www.jstor.org/stable/pdf/4532401.pdf

And, as mentioned, I would not necessarily consider 1980’s Israel a fully (geo)politically-stable peacetime country.

New Zealand

For starters: New Zealand, like in the Barber term in the UK, went through sharp financial deregulation in the 80s leading to a large increase in private sector borrowing. This likely is part of any story involving 80s inflation in New Zealand, as it was during the early 70s UK.

Once credit was no longer rationed, there was a large increase in private sector borrowing, and a boom in asset prices. Numerous speculative investment and property companies were set up in the mid-eighties. New Zealand’s banks, which were not used to managing risk in a deregulated environment, scrambled to lend to speculators in an effort not to miss out on big profits.

Overall, the mid-80s was a period of financial turbulence in New Zealand beyond just the early 80s spending by the Muldoon government. “Within a week of the [1984] election, virtually all controls over interest rates had been abolished. Financial markets were deregulated, and, in March 1985, the New Zealand dollar was floated. Other changes followed, including the sale of public sector trading organizations, the reduction of tariffs and the elimination of import licensing.” (Source). To simply credit “government spending” as a cause when so many things were happening is very simplistic.

I mentioned that Edmond is an “FTPL” type, and to the extent that basic MMT emphasizes that taxes drive currency, there are interesting overlaps in the schools. (see Tcherneva, The return of fiscal policy: Can the new developments in the new economic consensus be reconciled with the Post-Keynesian view?)

To be clear, many MMT scholars (correctly) view “inflation” as a complex phenomenon beyond a simple tax/spend/resources relationship. (e.g., An MMT response on what causes inflation; and Interest and Inflation – The Question?-Warren Mosler, youtube.)

If you spend without taxing sufficiently, MMT 101 says your tax-credit will not be sought after (valued). “Taxes Drive Currency” is the most basic insight of MMT (Mosler/Buckaroo, Wray).

So yes, if that ratio is skewed, the loss of value of the tax-credit will ensue.

This is very evident in Edmond’s New Zealand example, and well understood by the Kiwi’s (In practice at any rate; GST = goods and services tax).

So yes, there was possibly a spending/low taxation induced influence on inflation in 1980’s New Zealand (although remember the NZ $ was floated in 85 etc; a complex situation). A relatively fast government response fixed that (remember: unresponsive fiscal policy is one of the main arguments against MMT, ignoring the ineffectiveness of interest rate manipulation and the rapid effects of automatic stabilizers).

At any rate, out of hundreds of regimes/countries over many decades of modern economies, I have had 7 examples that were meant to show that government spending leads to inflation.

While of course theoretically possible, and as the passage from Part I showed, the reasons to fear poor responses from democratic governments regarding inflation related issues, the facts simply do not seem to support the fear.

The 7 examples above range from zero to possibly very mild at most cases where government spending was related to problematic levels of inflation.

In all of the cases, external forces (in the 1970s), tax cuts (but not spending on social programs), exchange-rate effects on small open economies,or in Spain’s case in the 1960s (and South Korea’s case to some extent) just searingly hot economies.

I think there are few developing countries today that would not be beyond “thrilled” to go through what Spain and South Korea went through in the last 70 years. What little, likely non-spending induced inflationary periods Spain experienced in Edmond’s 60s and “1990” example are largely irrelevant to the real living standards and real resource improvements for the Spanish and South Korean people in the last 7 decades.

Inflation from spending is simply not a “thing” in stable democratic countries.

The historical record is definitively not “littered with counterexamples.”

Notes

White, Bruce (2013) “Macroeconomic Policy in New Zealand: From the Great Inflation to the Global Financial Crisis.” New Zealand Treasury Working Paper, No. 13/30.

Related works:

Andersen, Palle Schelde and Mar Gudmundsson. 1998. “Inflation and Disinflation in Iceland”

BIS Working Paper No. 52.

Knight, Peter T., F. Desmond McCarthy, and Sweder van Wijnbergen. 1986. “Escaping hyperinflation: How Argentina, Brazil, and Israel curbed the threat of hyperinflation”. Finance & Development, International Monetary Fund.

Reuveny, Rafael. 1997. “Democracy, Credibility, and Sound Economics: The Israeli Hyperinflation.” Policy Sciences Vol. 30, No. 2, pp. 91-111